Unlock Your Financial Potential with Mindbugg

Empower Your Wealth Management with Expert Financial Solutions

About Us

At mindbugg, we are dedicated to providing expert financial solutions for individuals and businesses. With a focus on accuracy and attention to detail, our team of professionals excels in accounting, tax planning, and financial consulting. We are committed to helping our clients achieve their financial goals and thrive in today's complex financial landscape. Trust mindbugg for all your finance needs.

Financial Planning 101: A Beginner's Guide to Managing Your Money

Setting Clear Financial Goals

Creating specific and achievable financial objectives is crucial for effective financial planning. This involves assessing one's current financial standing, identifying future needs, and setting measurable goals.

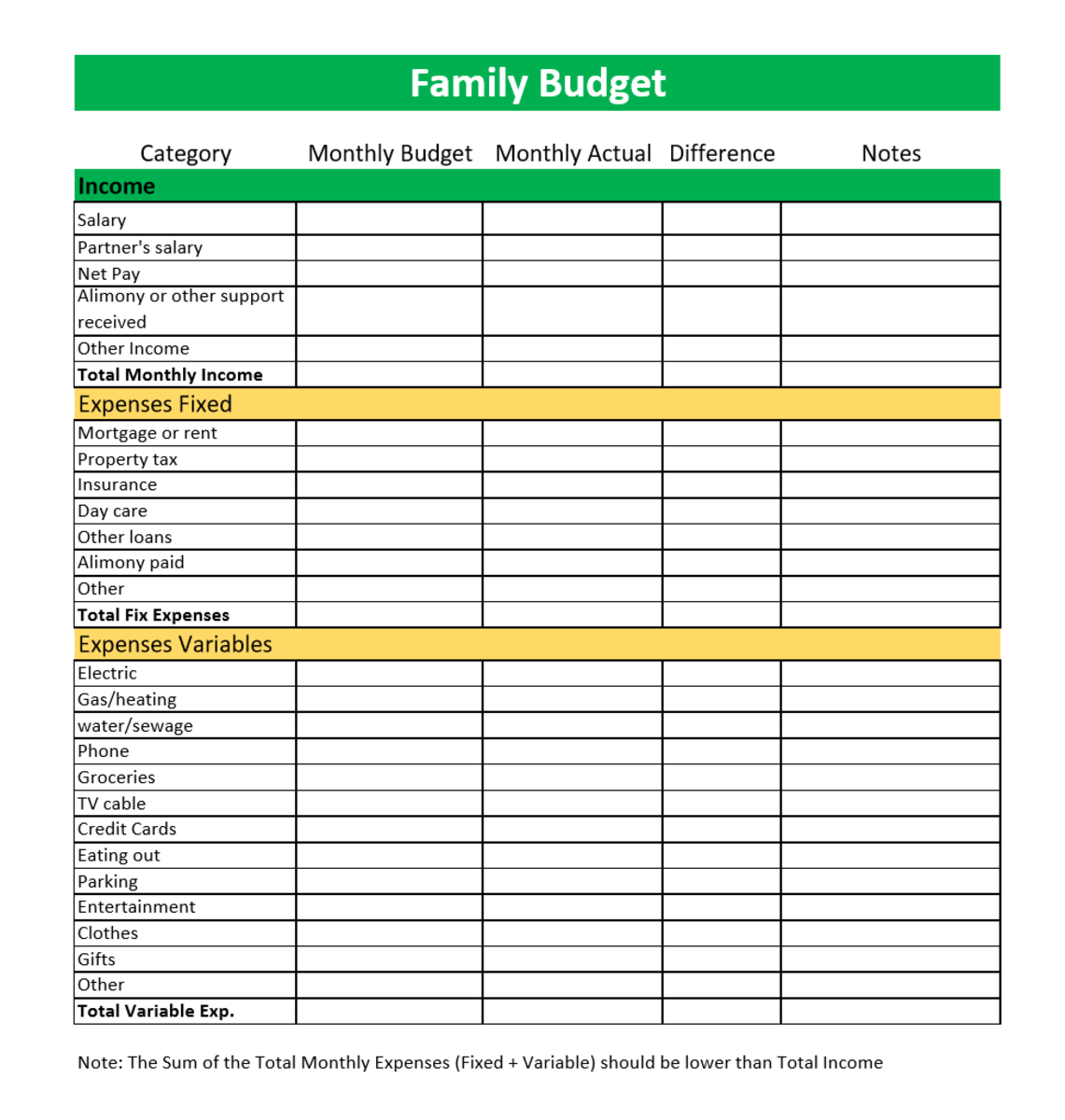

Budgeting and Expense Management

Practicing disciplined budgeting and tracking expenses helps in understanding spending patterns, identifying areas for savings, and ensuring that funds are allocated appropriately in line with financial goals.

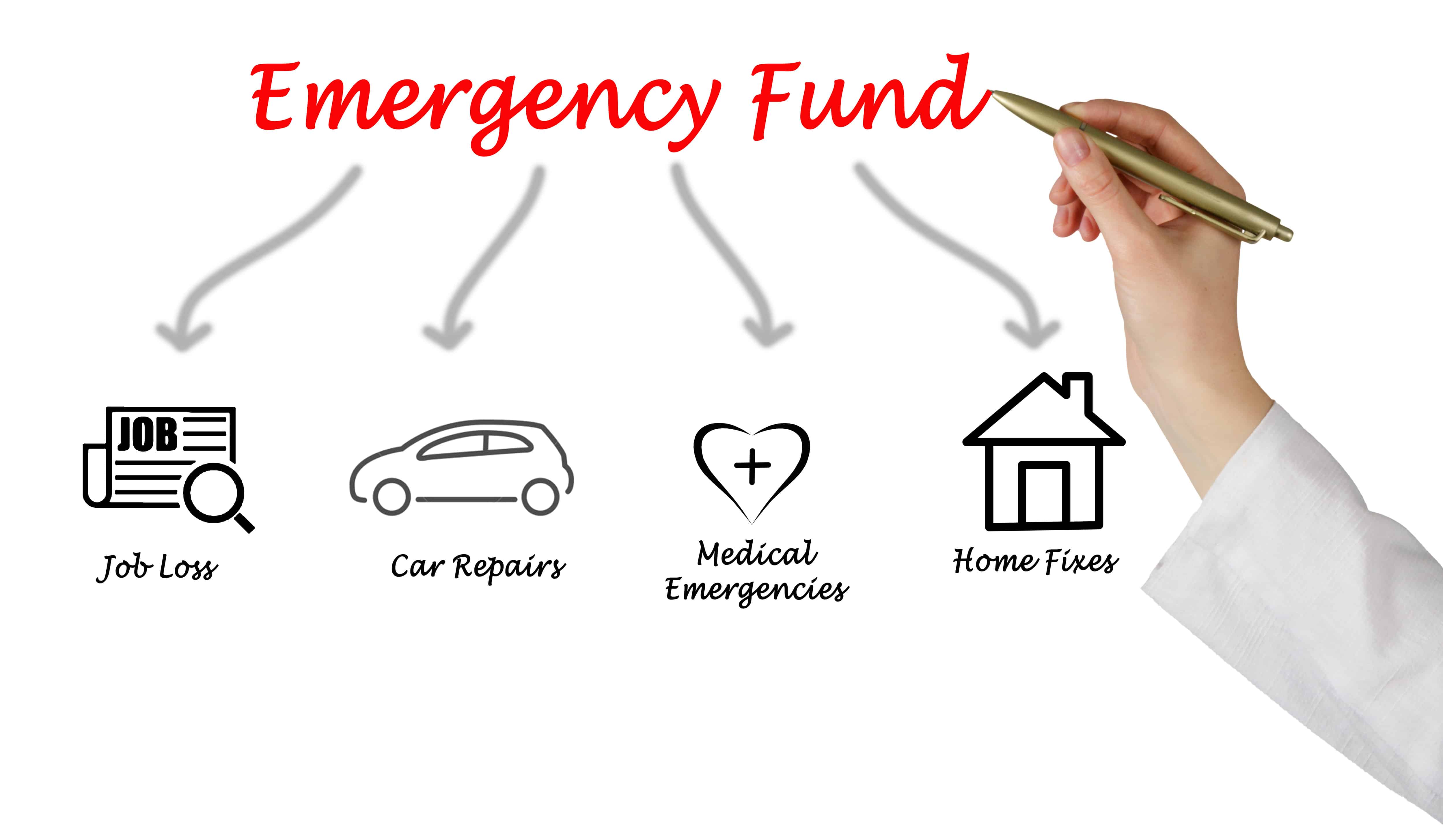

Establishing an Emergency Fund

Building an emergency fund to cover unforeseen expenses provides financial security and reduces reliance on credit. This fund acts as a safety net and contributes to financial stability.

Understanding Investment: How to Make Your Money Work for You

Diversification is Key

Spread your investments across different asset classes such as stocks, bonds, and real estate to minimize risk and maximize returns.

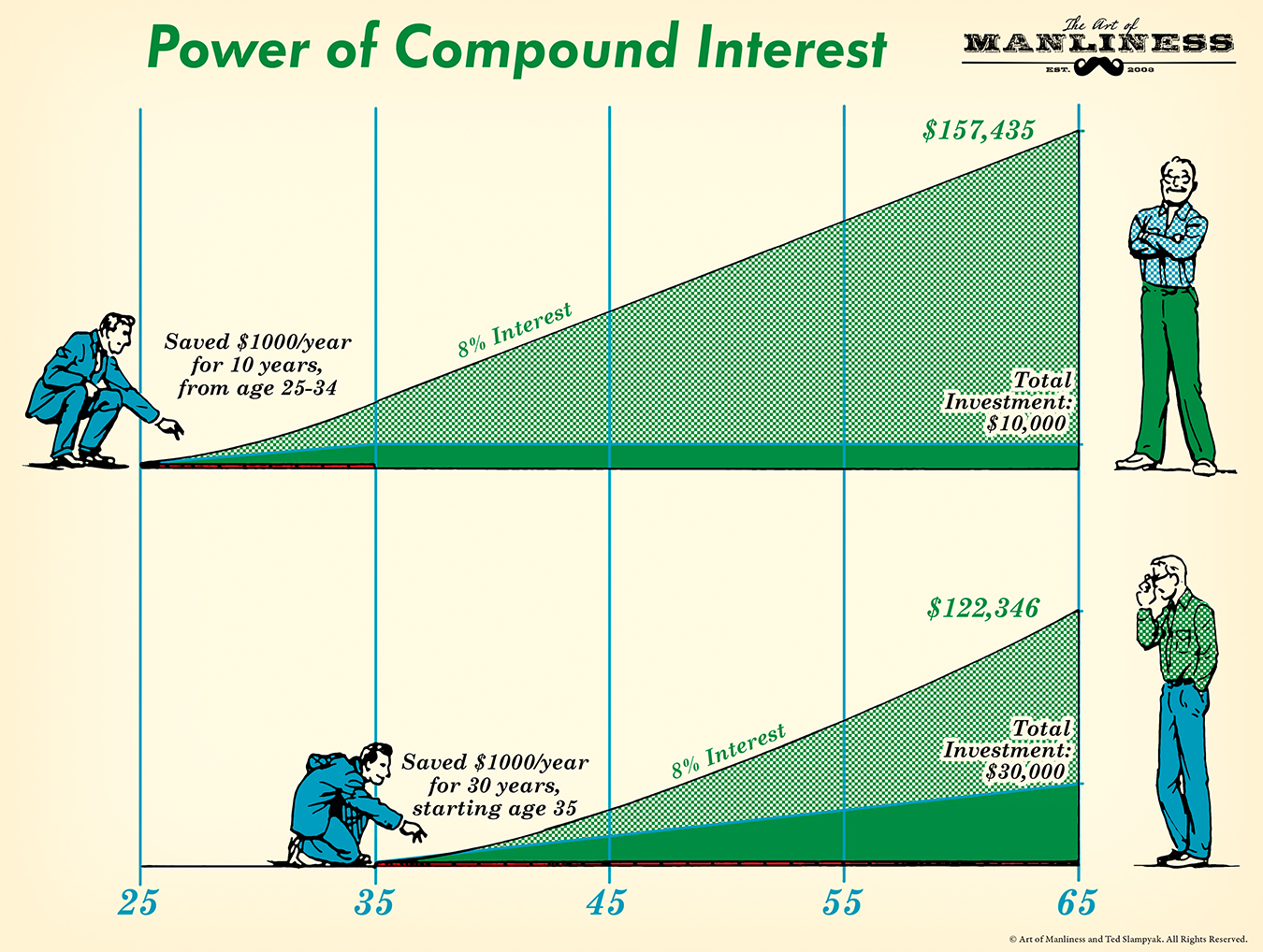

Start Early, Benefit from Compounding

Investing early allows you to benefit from the power of compounding, where your earnings generate returns over time, resulting in substantial wealth accumulation.

Stay Informed and Seek Professional Advice

Keep abreast of market trends and financial news to make informed investment decisions. Additionally, consider seeking advice from financial professionals to align your investments with your financial goals.

Mastering Personal Finance: Tips and Strategies for Financial Success

Budgeting for Financial Control

Creating and sticking to a budget is essential for managing personal finances. It helps track expenses, prioritize spending, and save for future goals.

Investing for Long-Term Growth

Diversifying investments, understanding risk tolerance, and staying informed about market trends are key to building wealth and securing financial stability.

Debt Management and Reduction

Developing a strategy to pay off debts, avoiding unnecessary borrowing, and negotiating better loan terms can alleviate financial burdens and improve creditworthiness.

Our Services

Financial Analysis

Comprehensive analysis of financial data to evaluate performance and make informed business decisions.

Budgeting and Forecasting

Developing realistic budgets and forecasts to effectively manage financial resources and plan for the future.

Tax Planning and Compliance

Strategic tax planning to minimize tax liabilities and ensure compliance with tax laws and regulations.